How it works

When it comes to finances, everyone sings a different tune, here’s how TempoPay fits into your wallet:

The basics

TempoPay is available through your employee benefits or health plan. It functions as a revolving account, similar to a credit card. When you sign up, you get immediate access to a set amount of funds to pay for healthcare expenses up front and then repay them over time.

Unlike most credit cards, your TempoPay account is always interest-free with no fees. Using TempoPay doesn’t affect your credit or credit score, because we never check it in the first place.

Where to use TempoPay

You can use TempoPay at the doctor’s office, the pharmacy, the dentist or orthodontist, for eyeglasses or contact lenses, and more. Pay your medical bills online (or the one sitting on your kitchen counter right now). Use it for lab work, therapy, chiropractors, physical therapy, specialists, medical supplies, and more.

Some employer programs do have different spending categories than the ones listed above. Contact our support team if you have questions about where you can use your card.

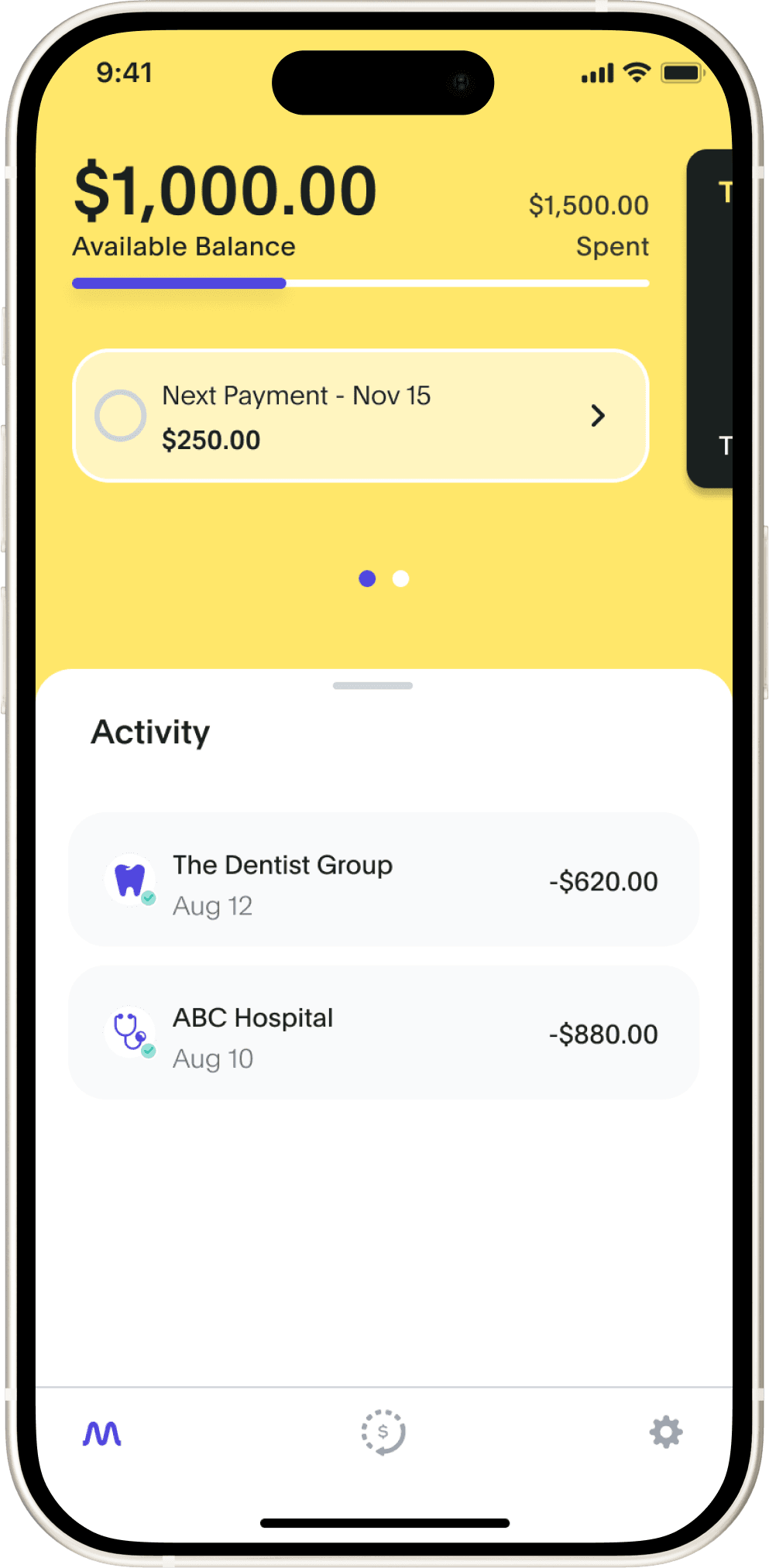

Managing repayments

Once you use the card and the charge settles, a repayment plan is created based on your preferences. You can change the length of time you want to repay based on your payroll cycle.

In most cases, repayment is connected to your company’s payroll. The repayment amount is withheld from your paycheck after taxes. You’ll see it all happen right in the TempoPay app.

Some people like the simplicity of paycheck withdrawals, but it’s not for everyone. So you can also connect a personal bank account and repay however you’d like!

Other accounts

If you have a Health Savings Account (HSA) or Flexible Spending Account (FSA) you can still contribute to these accounts and use TempoPay.

For example, if you want to keep your HSA growing for the future, you may begin to invest those contributions on a tax-free basis.

If you need to pay for care and don’t have enough funds in your FSA yet, you could pay with TempoPay and reimburse yourself once your FSA is fully funded.

Your money, your way!